Nearly two million people have now applied for Universal Credit (UC) as a result of difficult financial circumstances during the lockdown.

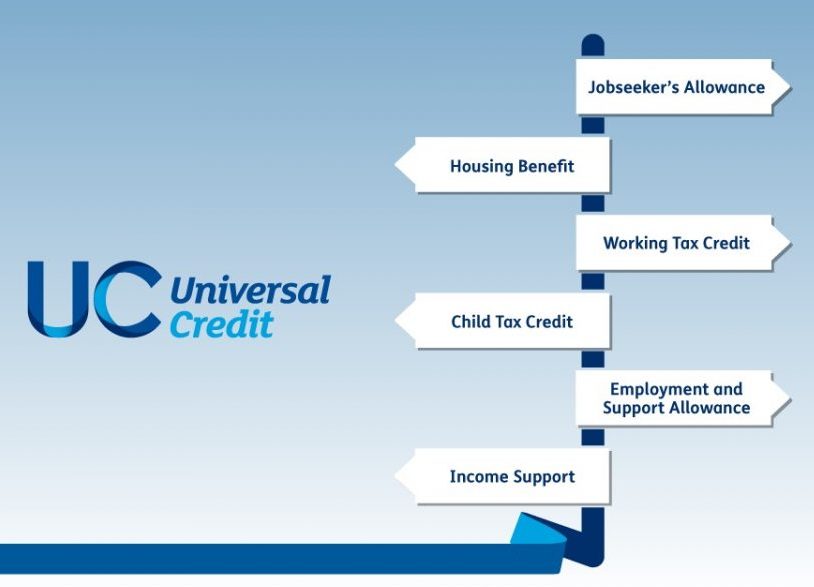

Introduced in 2013 to simplify the benefits system, UC brings together child tax credit, housing benefit, income support, jobseeker’s allowance, employment and support allowance and working tax credit.

There is a lot to understand with Universal Credit, and confusion can sometimes lead to wrongful notions about this benefit scheme. So we have put together a myth-busting article to help prospective claimants understand the process. For example, applying for UC does not have to be difficult or stressful, JSA still exists, and you can claim even if you’ve got savings.

Who can claim?

UC is not just for the unemployed. You can claim Universal Credit if you are working, you are furloughed or on a low income. UC was designed to be easy to apply for, so if you ever used the old benefits system you may remember the frustration of having to apply for lots of different benefits at once, being passed from pillar to post, which could be off-putting. If you take a look at the new system you may be surprised to find it’s easier to apply than you think.

Can I backdate my claim?

UC is rarely backdated, so can only be paid from the time you apply. It’s really important that, if you are struggling to make ends meet, you don’t wait too long hoping that things will just get back to normal soon or else you could miss out on something you are entitled to. If you’ve been working and paid your national insurance contributions for a while too you might also be entitled to new style Job Seeker’s Allowance (JSA), with UC topping it up.

Can I get an advance on my UC payment?

Normally UC is paid in arrears, but if you are in desperate need you can apply for an advance payment. This has to be paid back over time, but it can help see you through if money is really tight. It can contain an element to include your housing costs. At the moment all Job Centre interviews are suspended so you won’t even need to attend in person.

Do the payments stop if I work more?

With so many new claims having been submitted recently, many may wonder how the payment is affected by earnings. Unlike Jobseeker’s Allowance, payments don’t stop once the claimant works more than 16 hours a week. UC is affected by an earnings taper rate, meaning the amount that a person gets will reduce as they earn more. In some cases, a person may be eligible for a work allowance, and this is an amount they can earn before their UC payment is affected. The earnings taper rate is currently 63 percent.

Do I have to pay my rent during COVID-19?

Your rent has not stopped during the Covid-19 outbreak and if you don’t meet your payments you’ll be building up debt which could put your home a risk. Talk to us if you’re struggling and we’ll work together to find a way out. Call us on 0121 748 8100

Is the allowance the same during COVID-19?

In anticipation of more people applying for benefits, the government has made the system more generous. It has increased the standard allowance that the monthly baseline every household receives by £1,000 (upping payments by around £20 a week) for all new and existing claimants for 12 months. This means that if you have applied before and were not eligible, you might be now.

It has also removed the minimum income floor (a calculation set at the national minimum wage, based on how many hours self-employed claimants have worked) to ensure higher payments for those who are self-employed but unable to earn in this period.

Can I claim Tax Credits and Universal Credit at the same time?

If you are an existing tax credit claimant, this does not mean you will be automatically eligible to receive UC. If you submit a UC claim your tax credit award will be closed immediately, even if you are not eligible for UC! So if you currently receive tax credits, please check the eligibility criteria for UC before you submit a claim.

Claiming for either UC or JSA is straightforward so if you’re entitled to these benefits, please don’t struggle without. We would recommend applying for JSA first as there are just a few quick questions to see if you qualify, and if you don’t, you can go straight to a UC claim instead. It could take less than 5 minutes!

For more information on applying for these scheme, please follow the below links:

Claim Job Seekers Allowance here: – https://www.gov.uk/guidance/new-style-jobseekers-allowance

Claim Universal Credit here: – https://www.gov.uk/universal-credit